In common with many other organisations in both the public and the private sector, this is not without its challenges. The withdrawal of the Rural Services Delivery Grant, announced on 30th October, is projected to reduce the amount of funding the Council receives by about £400,000 per year.

As an organisation dedicated to serving those who live, work or visit South Kesteven, one of the Council’s top priorities is to remain financially secure.

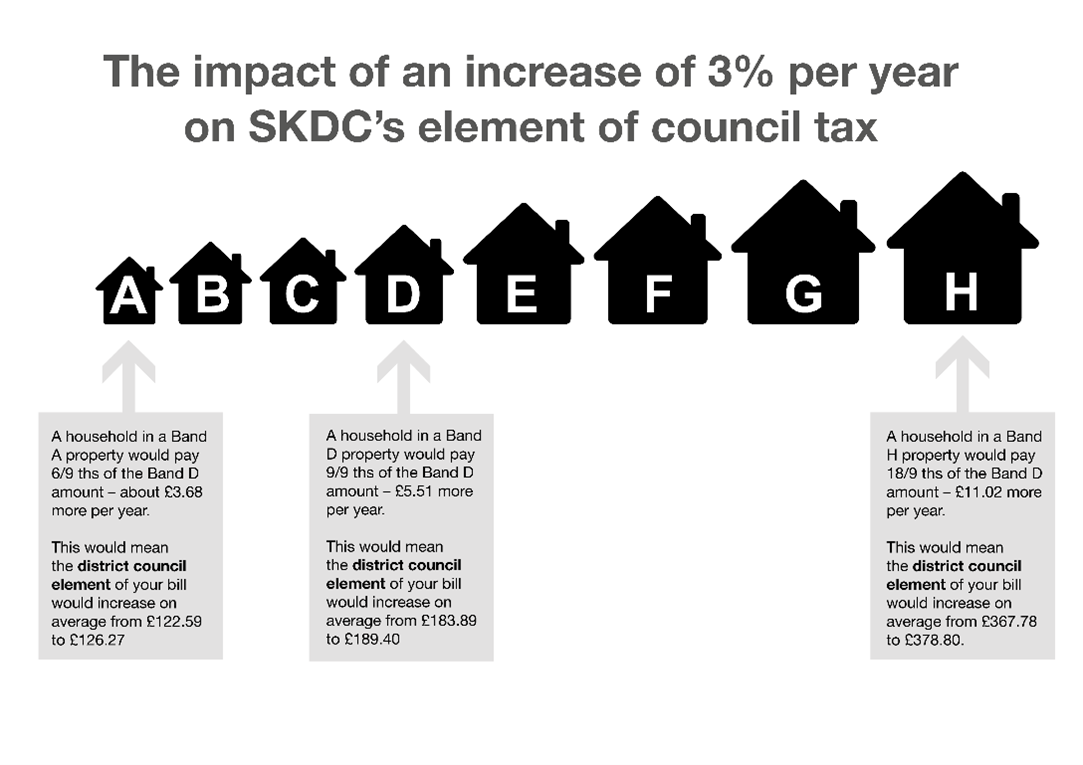

The revenue we raise from Council Tax is one of our main sources of income. To ensure that we are in a position where we can continue to protect and maintain the services we currently provide, we are proposing to increase our element of Council Tax from April 2025 by 3% for the financial year 2025/26 (per Band D).

This increase, if approved, will generate around £354,000 of additional funding.

A 3% increase ( per Band D) would mean households in Bands A, B or C would see the district council element of their bill increase on average by less than £5.51 in April 2025, those in Band D would see an average increase of £5.51 in the district council element of their bill ( from £183.89 to £189.40) and those in Bands E, F, G or H would see an average increase of more than £5.51 but no more than £11.02 in the district council element of their bill.

This is illustrated in the graphic below:

To find out how SKDC’s average Band D charge compared to 163 other shire district local authorities’ Band D charge in 2024/25 please click here.

To take part in this survey please click here.

PLEASE NOTE THIS CONSULTATION CLOSES ON 3 FEBRUARY 2025.